25+ Take Home Pay Calculator Sc

South Carolina payroll taxes South Carolina withholding tax. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022.

How To Prepare Flowchart To Input Marks In 7 Subjects Calculate The Total And Average And Display The Final Data Try To Use Loop Quora

South Carolina Income Tax Calculator 2021 If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Taxpayers can choose either itemized deductions or. How do South Carolina employers know how.

Important Note on the Hourly Paycheck Calculator. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. 30 8 260 - 25 56400.

Calculate your South Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free South. Supports hourly salary income and multiple pay frequencies. Your average tax rate is 1198 and your.

The adjusted annual salary can be calculated as. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The take home pay after taxes for a single filer who earns 51000 per annual is 4061940. Use ADPs South Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Simply enter their federal and state W-4.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in South Carolina. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. Just enter the wages tax withholdings and other information.

South Carolina Paycheck Calculator Frequently Asked. This South Carolina hourly. By using Netchexs South Carolina paycheck calculator discover in just a few steps what your anticipated paycheck will look like.

For a married couple with a combined annual income of 102000 it is 8069390. South Carolina uses graduated tax rates that range from 0 to 7 for 2022. The South Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and.

Freelancer Contractor Take Home Pay Calculations 2016 17 Jf Financial

How Do You Calculate The Size Of An Irregular Plot Irregular Shape Plot Area Calculation Part 1 Lceted Lceted Institute For Civil Engineers

1277 Academy Rd Bennettsville Sc 29512 Realtor Com

Download Centre Standard Chartered Pakistan

Paycheck Calculator Take Home Pay Calculator

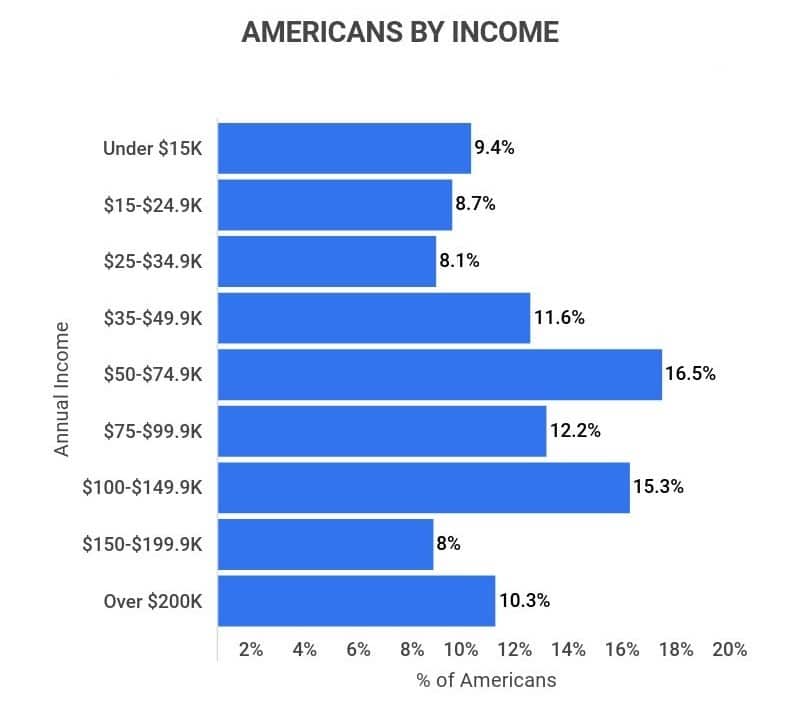

25 Essential Average American Income Statistics 2023 Household Personal Income In The Us Zippia

Contractor Take Home Pay Calculator Free Downlaod

South Carolina Income Tax Calculator Smartasset

Car Rental Enterprise Rental Cars Enterprise Rent A Car

South Carolina Agribusiness Loans Agamerica

What Is The Graph Of X To The Power Itself When X Is Positive X 0 X Is Negative Quora

Paycheck Calculator Take Home Pay Calculator

Texas Instruments Ti84plus Graphing Calculator Usb Technology Texas Instruments Amazon De Stationery Office Supplies

Texas Instruments Ti 84 Plus Ce T Rekenmachine Amazon De Stationery Office Supplies

Ingleside Apartments 9345 Blue House Road North Charleston Sc Rentcafe

10 Career Options After B Sc Mathematics

1277 Academy Rd Bennettsville Sc 29512 Realtor Com